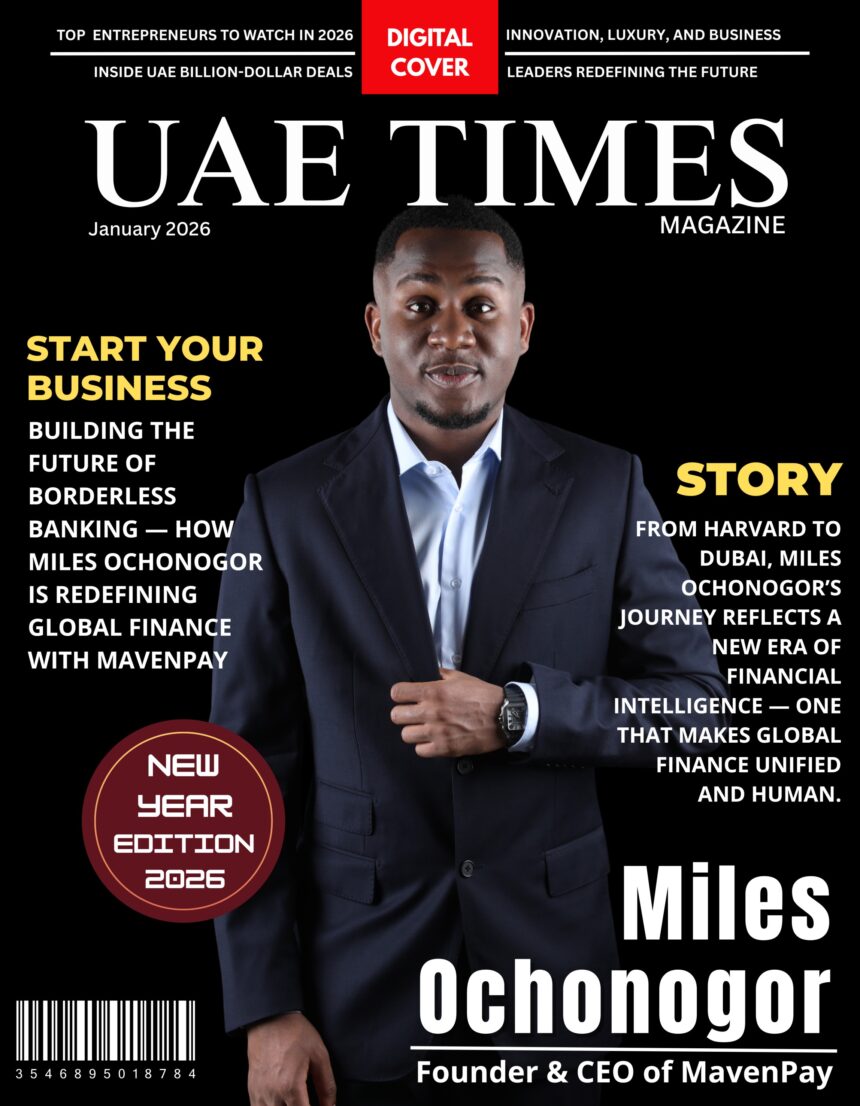

A Visionary Entrepreneur Redefining Global Payments

In today’s fast-changing financial landscape, few leaders are as forward-thinking as Miles (Chinedu Ochonogor) — a Dubai-based entrepreneur and the Founder of MavenPay, a next-generation financial platform designed for expats, founders, and globally mobile businesses.

At the core of Miles’ mission lies a powerful idea to simplify global finance by creating one central financial experience powered by AI, blockchain, and smart compliance systems. Through MavenPay, he aims to make global payments faster, more transparent, and accessible to all.

From Harvard to Dubai: A Journey of Global Learning and Leadership

Miles’ academic and professional background reads like a roadmap of modern innovation. His learning journey has taken him through Caltech, Harvard, and MIT, where he specialized in systems design, financial technology, and AI-driven market models.

At Caltech, he was introduced to enterprise systems and security architecture skills that shaped MavenPay’s “infrastructure-first” mindset. Later, at Harvard, his fintech-focused studies deepened his understanding of payment systems, global markets, and digital regulation.

Finally, at MIT Professional Education, Miles mastered digital platform strategy the art of building scalable two-sided markets. This experience sharpened his expertise in modular infrastructure, AI layers, and multi-currency product design all of which became core to MavenPay’s foundation.

What Inspired MavenPay

For Miles, MavenPay was born from personal experience. Having lived and worked across multiple financial systems, he saw the inefficiencies of international banking firsthand high fees, slow settlements, and limited access for startups and expats.

His response was to build a unified global platform that integrates multiple currencies, payment systems, and blockchain infrastructure to make finance truly borderless. Today, MavenPay bridges traditional banking with digital innovation, allowing users to manage global accounts, payments, and crypto holdings within a single ecosystem.

MavenPay: A Unified Financial and Lifestyle Platform

At its core, MavenPay is designed to make international finance seamless and intelligent.

The platform offers:

● Zero account-opening and minimum-balance fees

● Multi-currency accounts across G20 and MENA regions

● Cross-border settlements powered by Coinbase’s Base Layer 2 blockchain, ensuring speed, efficiency, and lower costs

● Mass payouts to over 180 countries for businesses, creators, and global teams

● Instant settlements for affiliates, healthcare, and travel agencies

Additionally, MavenPay features crypto treasury tools, AI-powered financial insights, and a Concierge Merits loyalty program that integrates travel, shopping, and lifestyle rewards. Soon, users will also enjoy a travel concierge assistant for booking hotels, flights, and lounges using loyalty points or crypto assets.

Near-Term Focus: Precision and Scale

In 2026, MavenPay is entering a defining phase. The company is finalizing its core infrastructure and banking partnerships, expanding its engineering and compliance teams, and preparing for a multi-currency account launch.

With an upcoming DFSA Category II license in Dubai, MavenPay is positioning itself as a fintech brand built on trust, transparency, and regulatory strength — aligning perfectly with the UAE’s digital economy vision.

Long-Term Vision: Building the World’s Most Trusted Global Fintech Brand

Over the next five years, Miles aims to transform MavenPay into a global financial institution serving individuals, businesses, and developers through open APIs and intelligent financial tools.

Future plans include:

● Expansion into Europe, India, and G20 markets

● AI-driven compliance systems for cross-border governance

● Brokerage and investment features for equities and funds

● Automated credit and lending systems for SMEs

● Advanced AI financial advisors for personalized global wealth management

Each step reinforces MavenPay’s mission — to make global finance intelligent, affordable, and borderless.

Core Values That Define MavenPay

● Trust & Transparency – Built with institutional-grade compliance and security

● Customer-Centric Design – Focused on real-world needs of expats and global founders

● Responsible AI Integration – Balancing innovation with accountability

● Scalable Infrastructure – Designed for resilience and long-term sustainability

● Alignment with UAE Vision 2031 – Supporting the nation’s leadership in fintech innovation

Miles Ochonogor’s Legacy in Motion

Miles Ochonogor is more than an entrepreneur he’s an architect of financial evolution. By combining AI intelligence, blockchain transparency, and fintech innovation, he’s shaping a future where financial freedom is not defined by geography.

MavenPay isn’t just a platform — it’s a movement towards smarter, safer, and simpler global banking.

To learn more, visit www.mavenpay.com or follow Miles @mavenpayapp for updates on the journey redefining the future of global finance.